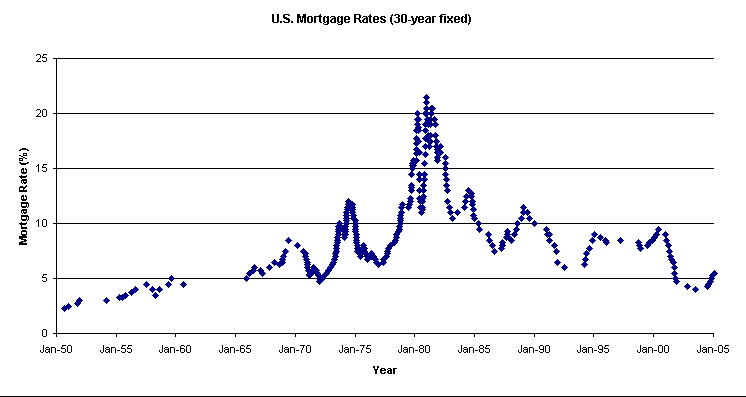

Thirty-year mortgage rates have tumbled this week to their lowest levels since late 2016, handing inexpensive borrowing costs to homeowners and greater threats to the money managers that invest in home loans.

Freddie Mac’s 30-year mortgage rate fell 0.11 percentage point this week to 3.73%, outspreading a downward movement that started in November, the company said Thursday. With rates having dropped more than a percentage point over that period, requests to refinance home loans are close to their highest levels since November 2016, a separate report said this week.

As the mortgage rate has fallen, homeowners have responded by applying to refinance their loans into lower rates, directing the refinance index to lean near its highest level since November 2016.

Refinancings are of the highest importance to the segment, as one of the main variables mortgage traders must accurately forecast to accurately value their investment is the speed at which the primary home loans will be paid off. For those who paid a premium for their bonds, this can hurt returns as they get their investment back more quickly than expected.

Falling rates mean MBS investors will need to enhance duration, denoted to as “convexity hedging.” They can do so by purchasing Treasuries, receiving fixed rates in swaps or even buying more MBS, where the inferior coupons usually offer higher duration.

Year-to-date net supply of agency MBS is about $51 billion, rendering to a latest report by Morgan Stanley. Their forecast for the year is about $210 billion in net supply, while 2018 saw $281 billion.

Be First to Comment